Mortgage Financing Redefined

The world’s largest Security Token Offering

To create a world where financial inclusion is the norm

Welcome to the “second wave” of capital democratization. Thanks to blockchain technology, investors can now access an asset class which was previously only available to the large banks, pension funds, Wall Street firms & billionaires!

At Radius we are creating asset-backed securities and are putting them on the blockchain. We are taking the liquid assets such as real estate loans and mortgages, which produce consistent, great and safe returns. We pool them and transform them into a transparent and liquid security (Token) that can be sold around the world and traded on blockchain secondary markets (ATS).

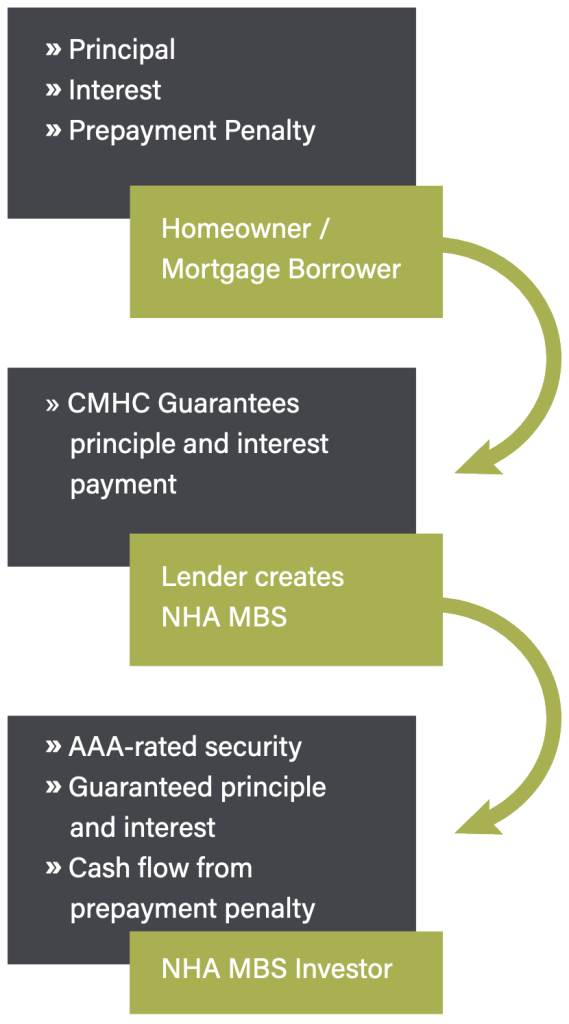

Radius will also use the capital raised in the sale of MoTokens to access Canadian government’s NHA MBS (Mortgage-Backed Securities) program. Mortgage assets in NHA MBS program have AAA ratings and are 100% guaranteed by the Canadian government!

Investment Highlights

1. Equity ownership in a fund with projected annual returns of 12-18%*.

2. Exposure to AAA-level investment instrument (refer to MBS) for everyday investors which was generally only available to major banks and large investment banks.

3. Significant returns with ZERO exposure to underlying corporate expenses.

4. Tax efficient structure that is projected to offer significant returns without any exposure to underlying corporate expenses or taxes.

5. 100% of the funds are used to fund prime mortgages(8) and borrowers, providing relatively secure investment, providing and enabling complete transparency and investor visibility on underlying assets.

6. Liquidity and accessibility driven by the blockchain and a developing global digital asset secondary market.

7. Comfort and transparency of being compliant with the SEC, OSC (Canada) & being Regulated by Canadian government agencies (CMHC, Financial Services Regulatory Authority).

8. KPMG (Auditor), SGGG (Providing fund valuation& Unitholder record keeping), Computershare (mortgage custodial trustee) and Securitize (Token issuance, administration and transfer agent) as part of this STO to make MoToken a trusted, transparent and honest token offering.

Raising $1.0 Billion with the aim to become the gold standards of the real estate and mortgage tokenization!

USE OF PROCEEDS

- 100% of all the Money raised in going to fund the Mortgages.

- 80% Of all returns are given to the Investors and Token holders.

- 100% of all expenses covered by radius portion.

- 100% managed, serviced, underwritten and hedged by Radius.

- 50x (Times) Leverage ability with the Government of Canada NHA MBS Program.

- The mortgages in NHA MBS are 100% insured by the Government of Canada and are “AAA rated.

THE MOTOKEN RETURNS

- 1% expense charge to cover direct operating expenses.

- The MoToken holders receive the first 4% return, net of expenses.

- Radius will receive the next 1% return as a “catch up”.

- All returns after the 4% preferred return & the 1% catch up will be split 80/20 in favor of LP investors.

Why Radius?

- Radius has a successful 16-year track record. In 2021 Radius was selected Mortgage Lender of the year in Canada by wining 9 Gold Medals and 1 Bronze out of 10 possible Medals. (Canada Mortgage Professional Magazine survey by Mortgage brokers in Canada)

- The Radius senior management team has over 80+ years cumulative experience in the mortgage industry. The Radius executives have overseen the funding of more than $220 billion in mortgages.

- Radius has strong institutional investors and partners, including Merrill Lynch/Bank of America, MCAP, Bank of Montreal. Laurentian Bank, Computershare and Finastra.

- Radius has funded over $7 billion in mortgages since inception and has a $1.5 billion assets under administration.

- Radius is an approved lender by the Canadian government and has a great relationship and track record with Canada’s top two mortgage insurance companies, CMHC & Sagen (Genworth).

- Radius’ mortgage portfolio is performing exceptionally well! With defaults (90+ days late in payments) at just 0.31% (approximately)

Why Canadian Mortgage Market?

- In the last 20 years, Canadian real estate has been one of the best performing and safest real estate markets in the world.

- In October of 2020, Canada’s government said it planned to admit 1.2 million new residents from 2021 to 2023, equivalent to 3% of the population.

- Strong immigration (over 400,000 individuals per year are projected from 2022-2026) and a shortage of supply due to infrastructure and a strong economy will foster demand for Canadian real estate for years to come.

- The rate of mortgage defaults in Canada is one of the lowest in the world.

- The Canadian real estate market is $5.9 trillion, with an MBS market size of $500 billion in principle amount outstanding as of the end of March 2020.

- Mortgages in MBS are fully insured by the Canada Mortgage and Housing Corporation (CMHC) and NHA MBS are assigned the same AAA rating as the agency.

- New government regulations (B20, Stress Test) make it extremely difficult for high quality clients such as doctors, dentists, lawyers, business owners, and entrepreneurs - even with great credit and a 25-50% down payment - to obtain mortgages.

What Will Radius Provide?

- All the expenses listed below will be covered by the initial 1% Radius will receive

- Currency swaps & Interest rate swaps (Hedge)

- Mortgage servicing (3rd party)

- Audit, legal and government fillings & professional fees

- Token platform (Securitize)

- Computershare trust services

- Warehouse & credit facilities

- Marketing & sales

- Mortgage Application Delivery platform (Provided by Finestra)

- Underwriting and cost associated with underwriting (Equifax reports, appraisals, underwriting platform, Title search, quality control & assurance)